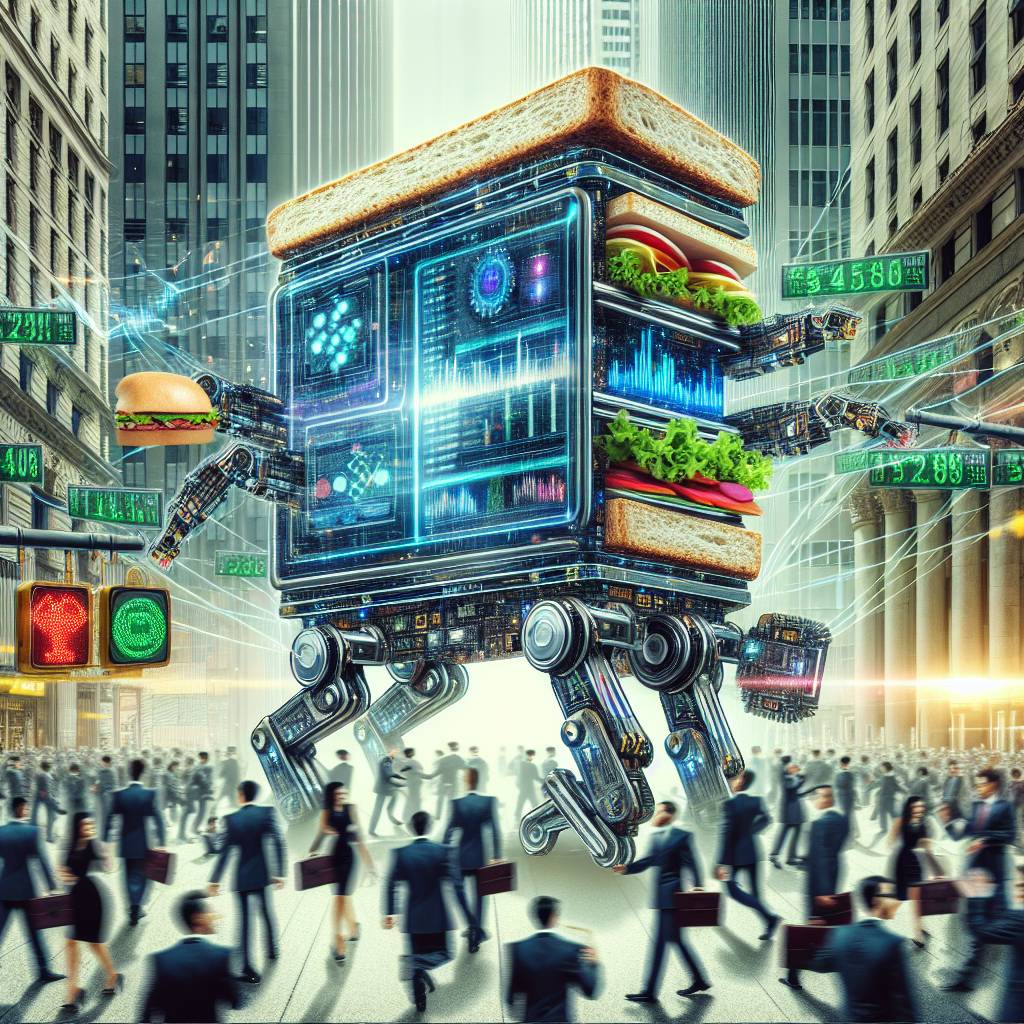

What strategies can be implemented with a crypto bot for ping pong trading?

Can you provide some strategies that can be implemented with a crypto bot for ping pong trading? I am interested in optimizing my trading performance using automated trading bots.

3 answers

- Sure! One strategy you can implement with a crypto bot for ping pong trading is setting up buy and sell orders at specific price levels. For example, you can set a buy order slightly below the current market price and a sell order slightly above the market price. This allows you to take advantage of small price fluctuations and generate profits from the price differences. The bot will automatically execute the trades when the price reaches the desired levels, saving you time and effort.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago - Absolutely! Another strategy you can try is using trailing stop orders. With this strategy, you can set a stop order that follows the price movement. For example, if the price goes up, the stop order will also move up, ensuring that you lock in profits if the price reverses. Similarly, if the price goes down, the stop order will move down, protecting your capital from further losses. This strategy helps you maximize your profits while minimizing your risks.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago - Definitely! BYDFi, a popular crypto trading platform, offers a ping pong trading bot that can help you implement various strategies. With BYDFi's bot, you can set up multiple buy and sell orders at different price levels, allowing you to take advantage of both upward and downward price movements. The bot also provides advanced features like stop-loss and take-profit orders, ensuring that you can manage your risks effectively. Give it a try and see how it can improve your trading performance!

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago

Related Tags

Hot Questions

- 99

How can I minimize my tax liability when dealing with cryptocurrencies?

- 88

What are the advantages of using cryptocurrency for online transactions?

- 72

Are there any special tax rules for crypto investors?

- 72

What are the best practices for reporting cryptocurrency on my taxes?

- 59

How can I buy Bitcoin with a credit card?

- 55

What are the tax implications of using cryptocurrency?

- 38

How does cryptocurrency affect my tax return?

- 30

What is the future of blockchain technology?