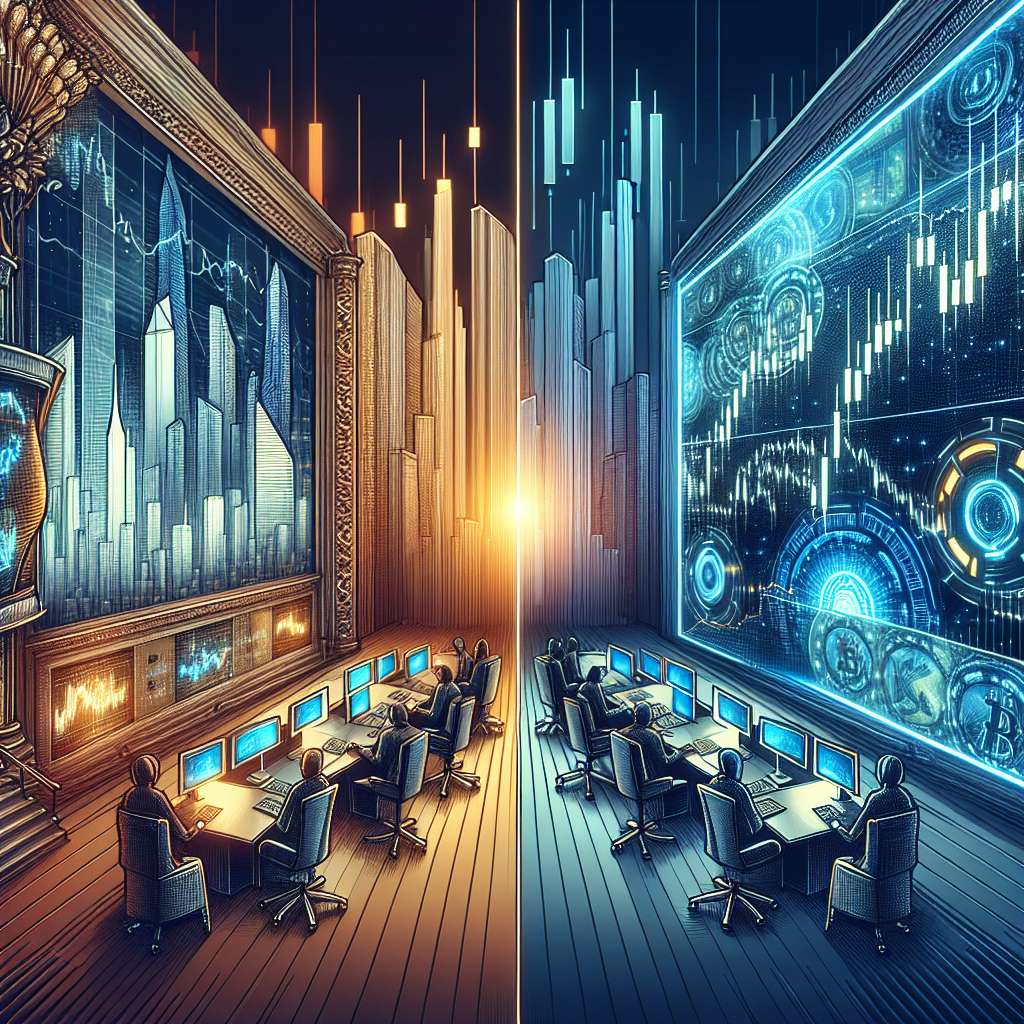

What is the impact of the next rate hike meeting on the cryptocurrency market?

As the next rate hike meeting approaches, many cryptocurrency investors are wondering how it will affect the market. What are the potential consequences of the rate hike meeting on the cryptocurrency market? How might it impact the prices of cryptocurrencies? Will it lead to increased volatility or stability in the market? What factors should investors consider in light of this upcoming event?

3 answers

- The impact of the next rate hike meeting on the cryptocurrency market is uncertain. Historically, rate hikes have been associated with increased market volatility. However, the cryptocurrency market is known for its unpredictability, and it is difficult to predict how it will react to this event. Investors should closely monitor market trends and news leading up to the rate hike meeting to make informed decisions.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - The next rate hike meeting could potentially lead to a decrease in the prices of cryptocurrencies. Higher interest rates could make traditional investments more attractive, leading investors to shift their funds away from cryptocurrencies. However, it is important to note that the cryptocurrency market is influenced by various factors, and the rate hike meeting is just one of them. Other factors, such as regulatory developments and technological advancements, can also have a significant impact on the market.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - At BYDFi, we believe that the next rate hike meeting will have a minimal impact on the cryptocurrency market. Cryptocurrencies are decentralized and operate independently of traditional financial systems. While rate hikes may affect traditional investments, cryptocurrencies are driven by different factors, such as market demand and technological innovation. Investors should focus on the long-term potential of cryptocurrencies and not be overly concerned about short-term fluctuations caused by rate hikes or other external events.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago

Related Tags

Hot Questions

- 95

How can I protect my digital assets from hackers?

- 92

How does cryptocurrency affect my tax return?

- 81

What is the future of blockchain technology?

- 76

What are the best digital currencies to invest in right now?

- 52

What are the tax implications of using cryptocurrency?

- 51

What are the best practices for reporting cryptocurrency on my taxes?

- 32

Are there any special tax rules for crypto investors?

- 24

How can I buy Bitcoin with a credit card?