What are the steps to cash out my Vanguard 401k and invest in digital currencies?

I have a Vanguard 401k and I'm interested in investing in digital currencies. What are the steps I need to take to cash out my Vanguard 401k and invest in digital currencies?

4 answers

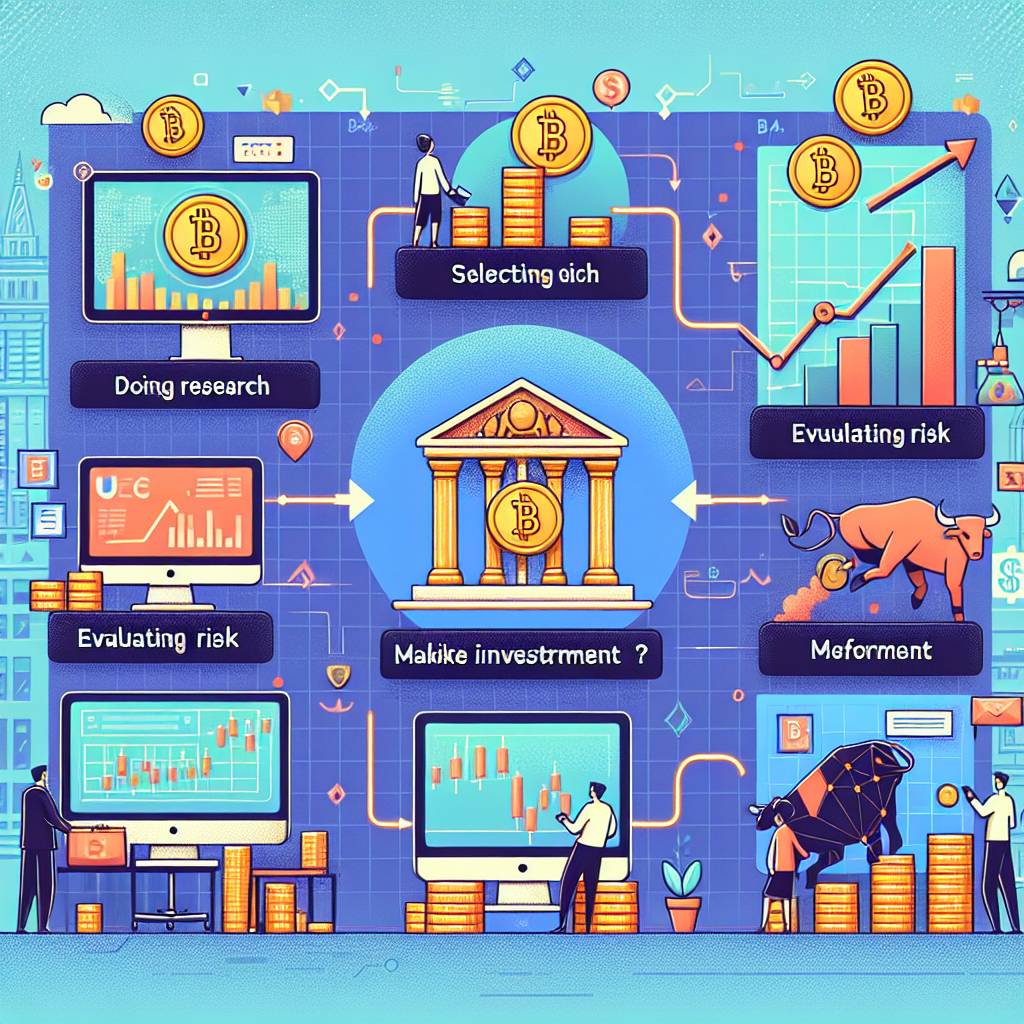

- To cash out your Vanguard 401k and invest in digital currencies, you will need to follow these steps: 1. Contact Vanguard: Reach out to Vanguard and inform them of your intention to cash out your 401k. They will guide you through the process and provide you with the necessary paperwork. 2. Complete the paperwork: Fill out the required forms provided by Vanguard. This may include a distribution request form and tax-related documents. 3. Choose a digital currency exchange: Research and select a reputable digital currency exchange where you can invest your cashed-out funds. Some popular exchanges include Coinbase, Binance, and Kraken. 4. Set up an account: Create an account on the chosen digital currency exchange. This may involve providing personal information, verifying your identity, and setting up security measures like two-factor authentication. 5. Transfer funds: Once your Vanguard 401k is cashed out, you can transfer the funds to your bank account. From there, you can deposit the funds into your digital currency exchange account. 6. Start investing: With your funds in the digital currency exchange account, you can now start investing in digital currencies. Research different cryptocurrencies, analyze market trends, and make informed investment decisions. Please note that investing in digital currencies carries risks, and it's important to do thorough research and consult with a financial advisor if needed.

Jan 06, 2022 · 3 years ago

Jan 06, 2022 · 3 years ago - Cashing out your Vanguard 401k and investing in digital currencies can be an exciting venture. Here are the steps you need to follow: 1. Contact Vanguard: Get in touch with Vanguard and let them know you want to cash out your 401k. They will provide you with the necessary information and guide you through the process. 2. Complete the paperwork: Fill out the required forms and documents provided by Vanguard. Make sure you understand the terms and conditions associated with cashing out your 401k. 3. Choose a digital currency exchange: Research different digital currency exchanges and select one that suits your needs. Look for exchanges with a good reputation, user-friendly interface, and strong security measures. 4. Create an account: Sign up for an account on the chosen digital currency exchange. Follow the registration process, provide the required information, and set up any additional security measures. 5. Transfer funds: Once your Vanguard 401k is cashed out, transfer the funds to your bank account. From there, you can deposit the funds into your digital currency exchange account. 6. Start investing: With funds in your digital currency exchange account, you can start investing in digital currencies. Research different cryptocurrencies, analyze market trends, and make informed investment decisions. Remember to stay updated on the latest news and developments in the digital currency market to make the most of your investments.

Jan 06, 2022 · 3 years ago

Jan 06, 2022 · 3 years ago - Cashing out your Vanguard 401k and investing in digital currencies can be a great way to diversify your investment portfolio. Here are the steps you can follow: 1. Contact Vanguard: Reach out to Vanguard and let them know about your plan to cash out your 401k. They will provide you with the necessary information and guide you through the process. 2. Complete the required paperwork: Fill out the forms and documents provided by Vanguard. Make sure you understand the terms and conditions associated with cashing out your 401k. 3. Choose a digital currency exchange: Research different digital currency exchanges and choose one that suits your needs. Look for exchanges with a user-friendly interface, strong security measures, and a wide range of available cryptocurrencies. 4. Create an account: Sign up for an account on the chosen digital currency exchange. Provide the required information and follow the account verification process. 5. Transfer funds: Once your Vanguard 401k is cashed out, transfer the funds to your bank account. From there, you can deposit the funds into your digital currency exchange account. 6. Start investing: With funds in your digital currency exchange account, you can start investing in digital currencies. Conduct thorough research, stay updated on market trends, and consider diversifying your investments across different cryptocurrencies. Please note that investing in digital currencies carries risks, and it's important to only invest what you can afford to lose.

Jan 06, 2022 · 3 years ago

Jan 06, 2022 · 3 years ago - Cashing out your Vanguard 401k and investing in digital currencies can be a smart move to explore new investment opportunities. Here's a step-by-step guide: 1. Contact Vanguard: Get in touch with Vanguard and inform them about your decision to cash out your 401k. They will provide you with the necessary information and assist you throughout the process. 2. Complete the necessary paperwork: Fill out the required forms and documents provided by Vanguard. Make sure to carefully review and understand the terms and conditions. 3. Choose a digital currency exchange: Research different digital currency exchanges and select one that aligns with your investment goals. Look for exchanges with a good reputation, strong security measures, and a wide range of available cryptocurrencies. 4. Create an account: Sign up for an account on the chosen digital currency exchange. Provide the required information, verify your identity if necessary, and set up any additional security measures. 5. Transfer funds: Once your Vanguard 401k is cashed out, transfer the funds to your bank account. From there, you can deposit the funds into your digital currency exchange account. 6. Start investing: With funds in your digital currency exchange account, you can start investing in digital currencies. Stay informed about market trends, conduct thorough research, and consider diversifying your investments across different cryptocurrencies. Remember to always invest responsibly and be aware of the potential risks associated with digital currency investments.

Jan 06, 2022 · 3 years ago

Jan 06, 2022 · 3 years ago

Related Tags

Hot Questions

- 74

How can I protect my digital assets from hackers?

- 71

What are the best digital currencies to invest in right now?

- 49

How does cryptocurrency affect my tax return?

- 45

How can I minimize my tax liability when dealing with cryptocurrencies?

- 42

What are the best practices for reporting cryptocurrency on my taxes?

- 39

How can I buy Bitcoin with a credit card?

- 37

What is the future of blockchain technology?

- 34

What are the advantages of using cryptocurrency for online transactions?