What are the risks and rewards of trading digital currencies versus Dec 22 cotton futures?

When comparing the risks and rewards of trading digital currencies with Dec 22 cotton futures, what factors should be considered? How do the potential gains and losses differ between these two types of trading? Are there any specific risks associated with digital currencies that are not present in cotton futures trading?

1 answers

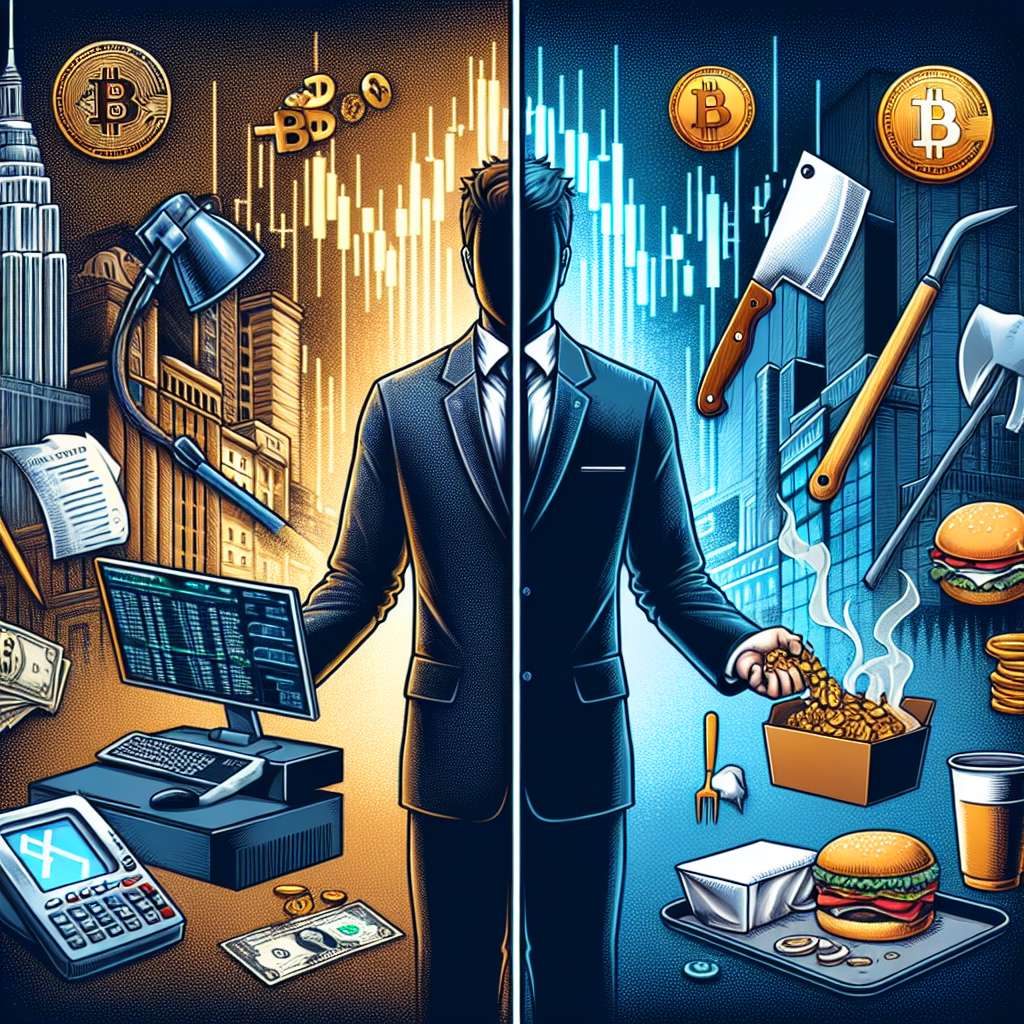

- As an expert in the field, I can say that trading digital currencies can be highly rewarding, but it also comes with its fair share of risks. The potential gains in the cryptocurrency market can be enormous, with some investors making significant profits in a short period of time. However, the market is highly volatile and prices can fluctuate dramatically. This volatility can lead to substantial losses if not managed properly. On the other hand, trading Dec 22 cotton futures is generally considered to be less risky, as the price of cotton is influenced by more stable factors such as supply and demand. However, the potential rewards in cotton futures trading may not be as high as in digital currencies. It's important for traders to carefully assess their risk tolerance and investment goals before deciding which market to enter.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago

Related Tags

Hot Questions

- 89

How can I buy Bitcoin with a credit card?

- 83

How can I protect my digital assets from hackers?

- 79

What are the tax implications of using cryptocurrency?

- 70

Are there any special tax rules for crypto investors?

- 36

What are the advantages of using cryptocurrency for online transactions?

- 30

What are the best digital currencies to invest in right now?

- 22

What is the future of blockchain technology?

- 11

How does cryptocurrency affect my tax return?