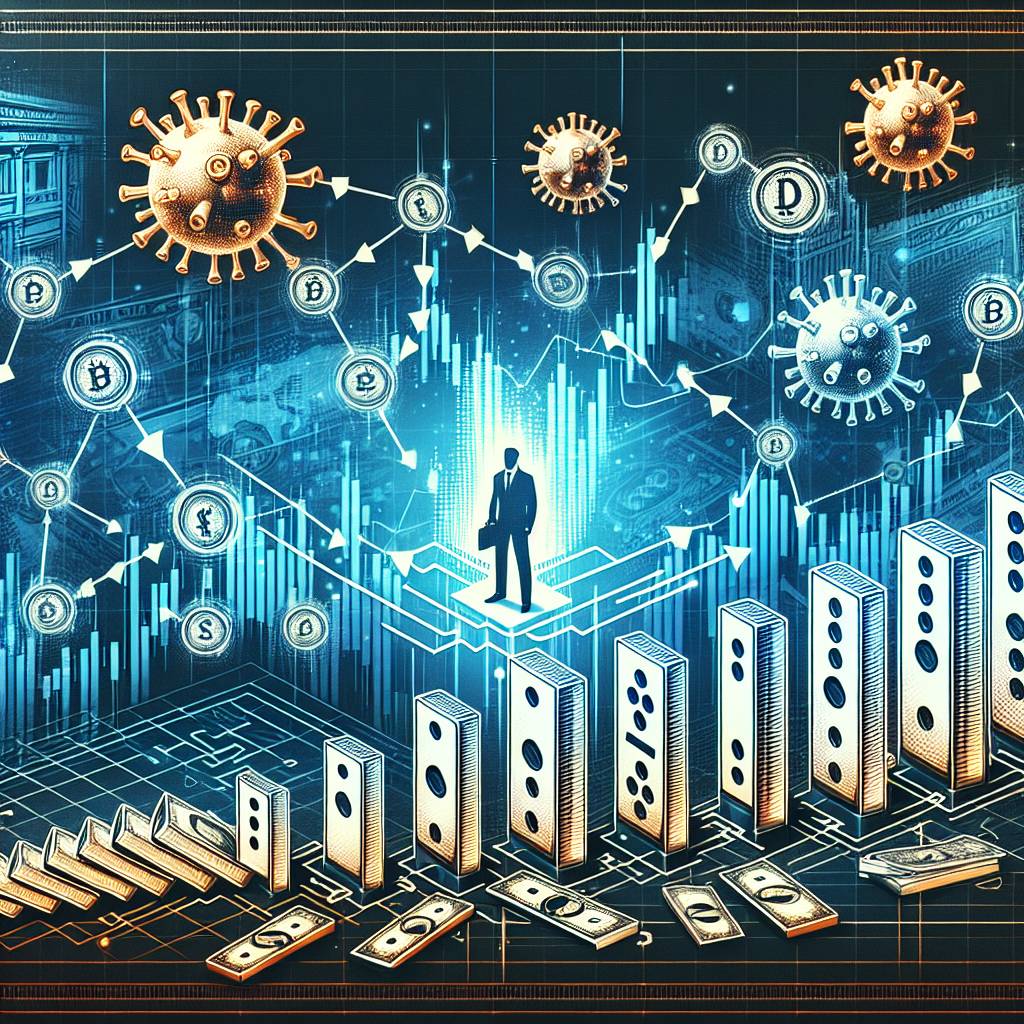

What are the potential contagion risks in the crypto market?

What are some of the potential risks of contagion that could affect the cryptocurrency market and its participants?

3 answers

- One potential contagion risk in the crypto market is the interconnectedness of different cryptocurrencies. If one cryptocurrency experiences a significant decline in value or faces a major security breach, it could have a ripple effect on other cryptocurrencies, causing a market-wide panic and leading to a decline in overall market confidence. This interconnectedness can amplify the impact of negative events and increase the potential for contagion. Another potential contagion risk is the reliance on centralized exchanges. Centralized exchanges act as intermediaries for cryptocurrency trading, and if a major exchange were to face a security breach or regulatory crackdown, it could have a domino effect on other exchanges and the entire market. This could lead to a loss of trust and liquidity, causing a widespread sell-off and further exacerbating the contagion risk. Additionally, the lack of regulation and oversight in the crypto market poses a significant contagion risk. Without proper regulations and safeguards, fraudulent activities, market manipulation, and insider trading can occur more easily, increasing the potential for contagion. A single instance of fraud or manipulation can erode market confidence and trigger a chain reaction of panic selling and contagion. To mitigate these risks, it is important for participants in the crypto market to diversify their portfolios, conduct thorough due diligence before investing in any cryptocurrency, and stay informed about the latest developments and regulatory changes. It is also crucial for regulators to establish clear guidelines and enforce regulations to protect investors and maintain market stability.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago - Contagion risks in the crypto market are a growing concern for investors and participants. One potential risk is the volatility of cryptocurrencies. The crypto market is known for its extreme price fluctuations, and when one cryptocurrency experiences a significant drop in value, it can create a panic among investors, leading to a contagion effect where other cryptocurrencies also experience a decline in value. Another potential contagion risk is the lack of transparency in the crypto market. Due to the decentralized nature of cryptocurrencies, it can be difficult to obtain accurate and reliable information about the fundamentals and financial health of different cryptocurrencies. This lack of transparency can make it easier for rumors and misinformation to spread, creating a fertile ground for contagion. Furthermore, the crypto market is highly influenced by market sentiment and speculative trading. If negative news or a market downturn triggers a wave of panic selling, it can quickly spread to other cryptocurrencies, causing a contagion effect. The herd mentality and emotional decision-making of investors can amplify the impact of negative events and increase the likelihood of contagion. To address these risks, it is important for investors to conduct thorough research, diversify their portfolios, and exercise caution when making investment decisions. It is also crucial for regulators to enhance transparency and establish mechanisms to monitor and mitigate contagion risks in the crypto market.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago - Contagion risks in the crypto market are a concern for both individual investors and the overall market stability. One potential contagion risk is the high correlation among different cryptocurrencies. When the price of one cryptocurrency experiences a significant decline, it can trigger a sell-off across the entire market, leading to a contagion effect. This high correlation can make the crypto market vulnerable to systemic risks and increase the potential for contagion. Another potential contagion risk is the lack of investor education and awareness. Many individuals are attracted to the crypto market without fully understanding the risks involved. This lack of knowledge can make investors more susceptible to panic selling and herd behavior, which can further amplify the contagion effect. Moreover, the crypto market is also exposed to external risks, such as regulatory changes and geopolitical events. If a major regulatory crackdown or a geopolitical crisis occurs, it can have a widespread impact on the crypto market, leading to a contagion effect and a decline in overall market confidence. To mitigate these risks, it is important for investors to educate themselves about the crypto market, diversify their portfolios, and adopt a long-term investment strategy. It is also crucial for regulators to provide clear guidelines and establish mechanisms to monitor and address contagion risks in the crypto market.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago

Related Tags

Hot Questions

- 84

What are the best practices for reporting cryptocurrency on my taxes?

- 71

How can I minimize my tax liability when dealing with cryptocurrencies?

- 54

What are the advantages of using cryptocurrency for online transactions?

- 52

How can I protect my digital assets from hackers?

- 46

How does cryptocurrency affect my tax return?

- 44

What are the tax implications of using cryptocurrency?

- 42

How can I buy Bitcoin with a credit card?

- 27

What are the best digital currencies to invest in right now?