What are the key components of an effective blockchain strategy for cryptocurrency trading?

What are the main elements that should be considered when developing a successful blockchain strategy for cryptocurrency trading?

3 answers

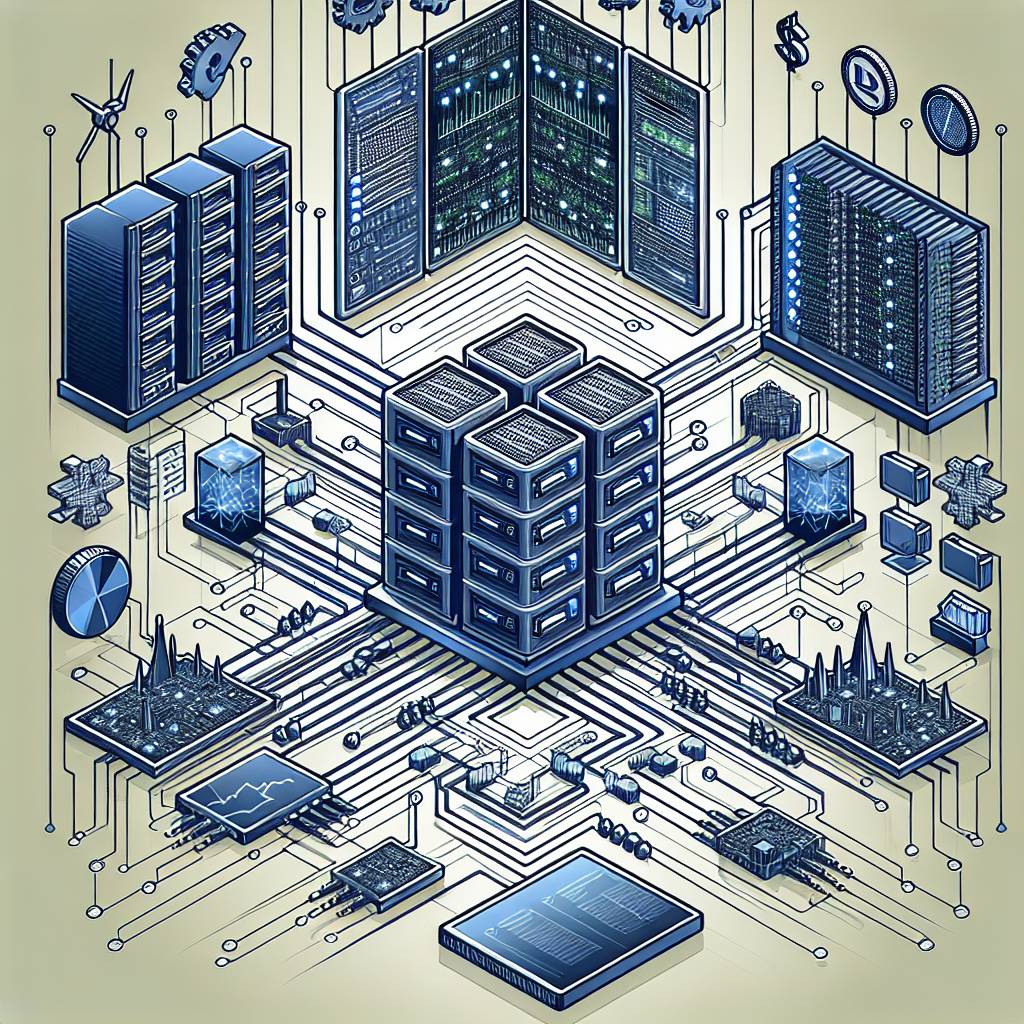

- An effective blockchain strategy for cryptocurrency trading should include a robust security system to protect users' funds and personal information. This can be achieved through the implementation of advanced encryption algorithms and multi-factor authentication methods. Additionally, the strategy should focus on scalability to handle a large volume of transactions and ensure fast and efficient processing times. It is also important to have a user-friendly interface and intuitive trading platform to attract and retain users. Furthermore, a comprehensive risk management system should be in place to identify and mitigate potential threats and vulnerabilities. Overall, a successful blockchain strategy for cryptocurrency trading requires a combination of security, scalability, user experience, and risk management.

Jan 01, 2022 · 3 years ago

Jan 01, 2022 · 3 years ago - When it comes to developing an effective blockchain strategy for cryptocurrency trading, one of the key components is transparency. By leveraging the transparency of blockchain technology, traders can have a clear view of all transactions and account balances, which helps to build trust and confidence in the trading platform. Another important component is liquidity. A successful strategy should ensure that there is sufficient liquidity in the market to facilitate smooth trading and minimize slippage. Additionally, integrating advanced trading tools and algorithms can help traders make informed decisions and execute trades more effectively. Lastly, staying updated with the latest regulatory developments and compliance measures is crucial to ensure the strategy aligns with legal requirements and avoids any potential legal issues.

Jan 01, 2022 · 3 years ago

Jan 01, 2022 · 3 years ago - BYDFi, a leading digital asset exchange, believes that an effective blockchain strategy for cryptocurrency trading should prioritize security, liquidity, and innovation. Security measures such as cold storage, two-factor authentication, and regular security audits are essential to protect users' funds. Liquidity is crucial for a vibrant trading environment, and BYDFi ensures deep order books and tight spreads to provide traders with optimal trading conditions. Innovation is also a key component, as BYDFi constantly introduces new features and trading options to enhance the user experience. By focusing on these key components, BYDFi aims to provide a secure, liquid, and innovative trading platform for cryptocurrency enthusiasts.

Jan 01, 2022 · 3 years ago

Jan 01, 2022 · 3 years ago

Related Tags

Hot Questions

- 86

Are there any special tax rules for crypto investors?

- 84

How can I buy Bitcoin with a credit card?

- 65

What are the tax implications of using cryptocurrency?

- 58

What are the best digital currencies to invest in right now?

- 42

How does cryptocurrency affect my tax return?

- 39

How can I minimize my tax liability when dealing with cryptocurrencies?

- 35

What is the future of blockchain technology?

- 31

How can I protect my digital assets from hackers?