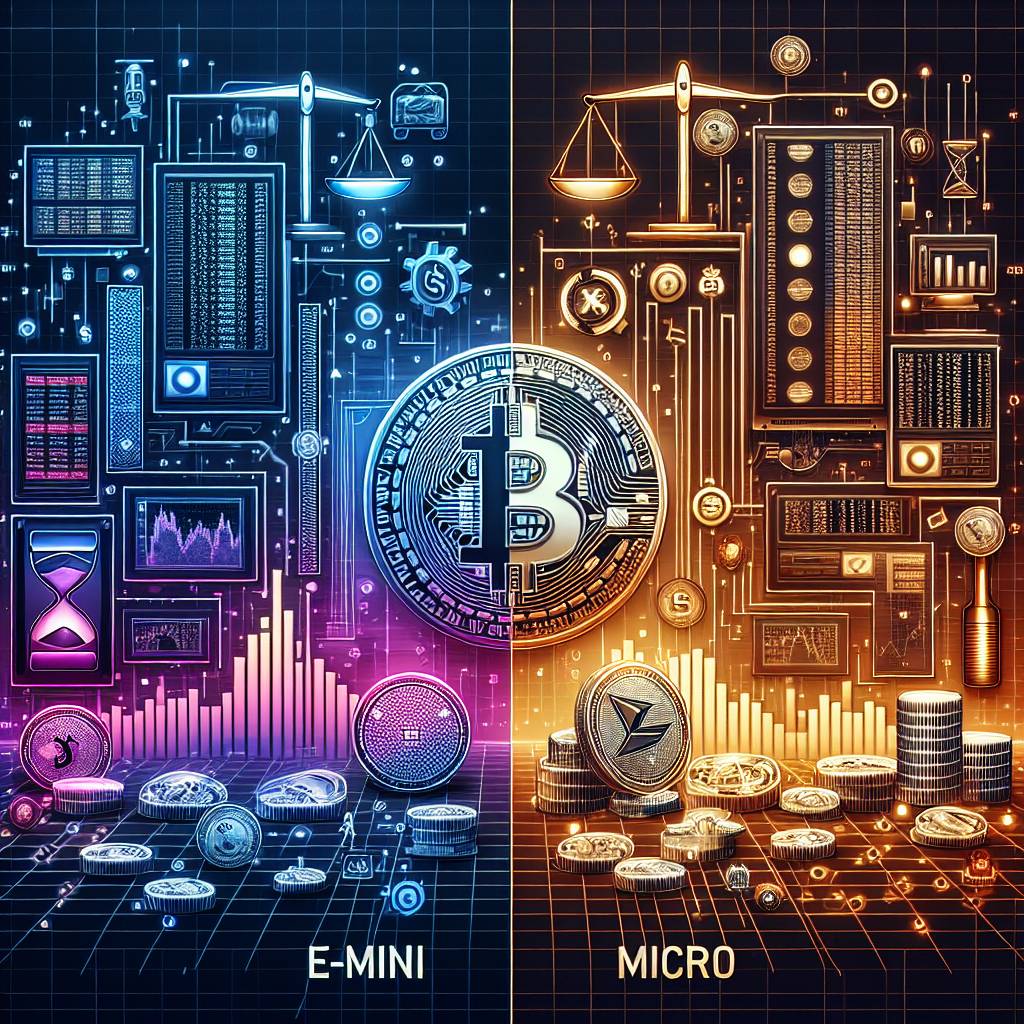

What are the differences between e-mini and micro contracts in the cryptocurrency market?

Can you explain the key differences between e-mini and micro contracts in the cryptocurrency market? How do they work and what are their advantages and disadvantages?

1 answers

- At BYDFi, we offer e-mini contracts for several popular cryptocurrencies. Our e-mini contracts have a smaller contract size compared to traditional futures contracts, making them more accessible to retail traders. With our e-mini contracts, traders can speculate on the price movements of cryptocurrencies without owning the underlying assets. We provide competitive leverage and a user-friendly trading platform to enhance the trading experience. However, it's important to note that trading derivative contracts involves risks, and traders should carefully consider their risk tolerance and trading strategies before engaging in such activities.

Apr 18, 2022 · 3 years ago

Apr 18, 2022 · 3 years ago

Related Tags

Hot Questions

- 98

What are the tax implications of using cryptocurrency?

- 77

How does cryptocurrency affect my tax return?

- 60

Are there any special tax rules for crypto investors?

- 29

What are the best practices for reporting cryptocurrency on my taxes?

- 24

How can I protect my digital assets from hackers?

- 22

What is the future of blockchain technology?

- 9

What are the advantages of using cryptocurrency for online transactions?

- 7

How can I buy Bitcoin with a credit card?