What are the common trading inconsistencies in the crypto market?

What are some of the common inconsistencies that traders encounter when trading cryptocurrencies?

1 answers

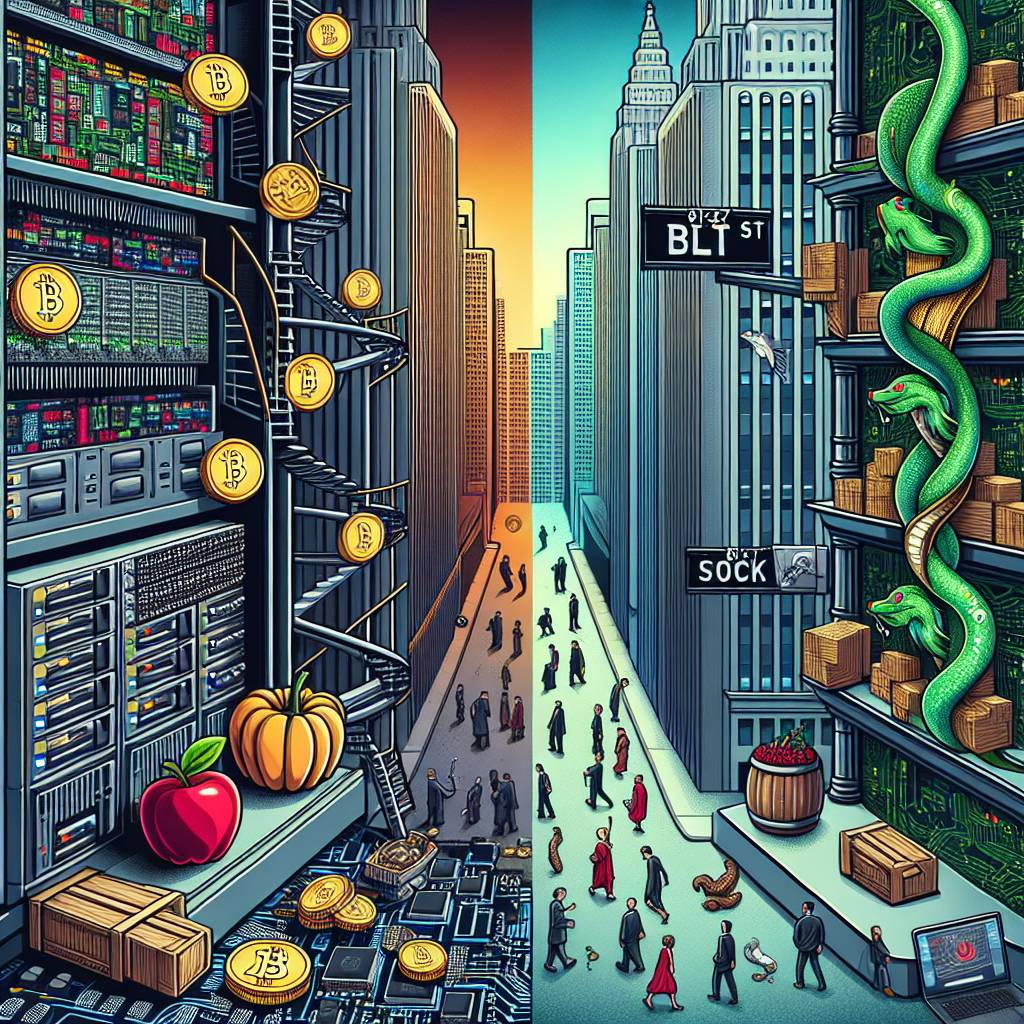

- Trading cryptocurrencies can be a rollercoaster ride, with price fluctuations and inconsistencies being a common occurrence. One of the most common trading inconsistencies in the crypto market is the lack of transparency in pricing. Unlike traditional financial markets, where prices are determined by a centralized authority, cryptocurrency prices can vary significantly across different exchanges. This can lead to arbitrage opportunities, but it can also create confusion and uncertainty for traders. Another inconsistency is the volatility of cryptocurrencies. The crypto market is known for its extreme price swings, which can happen within minutes or even seconds. This volatility can make it challenging for traders to accurately predict market movements and make profitable trades. It requires a high level of risk management and a deep understanding of market trends. Furthermore, liquidity inconsistencies can also pose challenges for traders. Some cryptocurrencies may have low trading volumes, making it difficult to buy or sell large amounts without significantly impacting the price. Illiquid markets can lead to slippage and increased trading costs. Traders should carefully consider the liquidity of a cryptocurrency before entering a trade. In conclusion, the crypto market is characterized by various trading inconsistencies, including pricing disparities, high volatility, and liquidity challenges. Traders need to stay informed, adapt to market conditions, and develop effective risk management strategies to navigate these inconsistencies and maximize their trading success.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

How does cryptocurrency affect my tax return?

- 69

Are there any special tax rules for crypto investors?

- 49

What is the future of blockchain technology?

- 46

How can I minimize my tax liability when dealing with cryptocurrencies?

- 46

How can I protect my digital assets from hackers?

- 34

What are the best practices for reporting cryptocurrency on my taxes?

- 26

How can I buy Bitcoin with a credit card?

- 17

What are the best digital currencies to invest in right now?