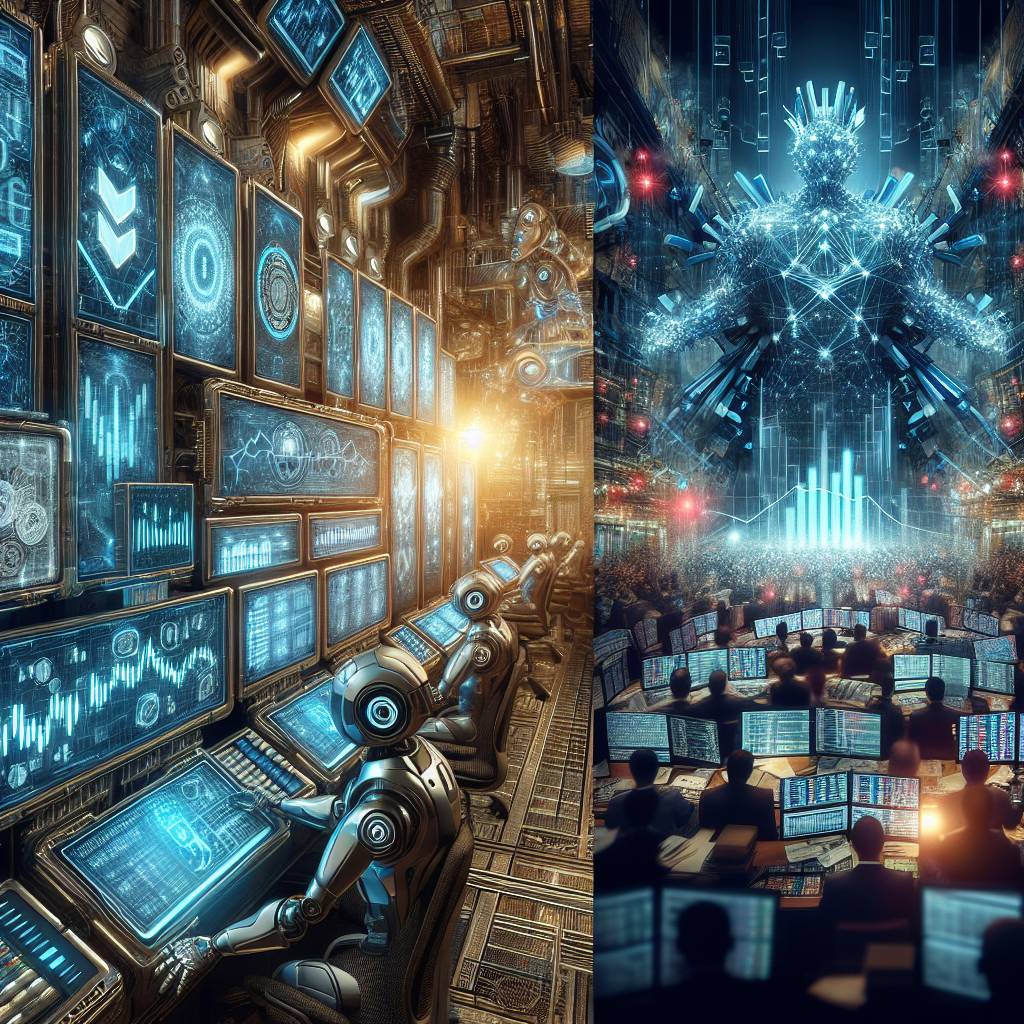

What are the best strategies for using flowalgo in cryptocurrency trading?

Can you provide some insights into the best strategies for utilizing flowalgo in cryptocurrency trading? I'm interested in understanding how to effectively use flowalgo to improve my trading decisions and maximize profits. Specifically, I would like to know how to interpret flowalgo data, identify potential trading opportunities, and manage risks. Any tips or advice on using flowalgo in cryptocurrency trading would be greatly appreciated!

1 answers

- At BYDFi, we believe that flowalgo can be a valuable tool for cryptocurrency traders. It provides real-time data on the flow of funds in and out of different cryptocurrencies, allowing traders to identify potential trading opportunities and make more informed decisions. However, it's important to note that flowalgo is just one piece of the puzzle. Successful trading requires a combination of technical analysis, fundamental analysis, and risk management. By using flowalgo in conjunction with other tools and strategies, traders can increase their chances of success in the cryptocurrency market. Remember to always do your own research and never invest more than you can afford to lose.

Mar 25, 2022 · 3 years ago

Mar 25, 2022 · 3 years ago

Related Tags

Hot Questions

- 99

What is the future of blockchain technology?

- 96

How does cryptocurrency affect my tax return?

- 90

What are the tax implications of using cryptocurrency?

- 85

Are there any special tax rules for crypto investors?

- 73

What are the best digital currencies to invest in right now?

- 55

How can I protect my digital assets from hackers?

- 46

How can I minimize my tax liability when dealing with cryptocurrencies?

- 40

What are the best practices for reporting cryptocurrency on my taxes?