What are the best strategies for using crypto trading bots?

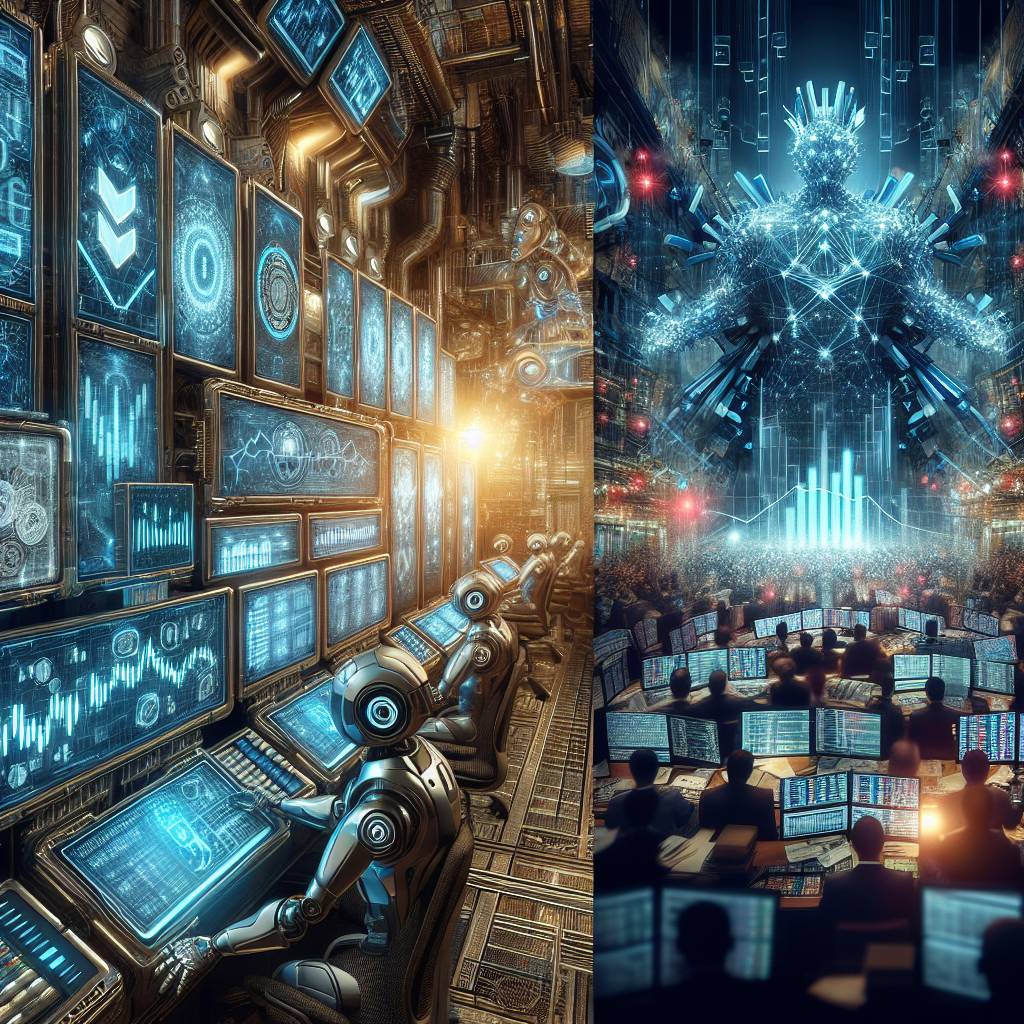

Can you provide some insights on the most effective strategies for utilizing crypto trading bots? I'm interested in learning about the best practices and techniques that can help maximize profits and minimize risks when using these automated trading tools.

3 answers

- Certainly! When it comes to using crypto trading bots, there are a few strategies that can be quite effective. One popular approach is trend following, where the bot is programmed to identify and follow the prevailing market trends. This can help capture profits during upward price movements. Another strategy is mean reversion, where the bot looks for overbought or oversold conditions and takes advantage of price reversals. Additionally, some traders use arbitrage strategies, where the bot simultaneously buys and sells the same asset on different exchanges to profit from price discrepancies. It's important to note that no strategy is foolproof, and it's crucial to constantly monitor and adjust the bot's settings to adapt to changing market conditions.

Jan 09, 2022 · 3 years ago

Jan 09, 2022 · 3 years ago - Well, using crypto trading bots can be a game-changer if you know what you're doing. One strategy that many traders swear by is called dollar-cost averaging. This involves buying a fixed amount of a particular cryptocurrency at regular intervals, regardless of its price. This strategy helps to mitigate the impact of short-term price fluctuations and can be particularly useful for long-term investors. Another approach is to set stop-loss orders, which automatically sell a cryptocurrency when its price reaches a certain predetermined level. This can help limit potential losses and protect your investment. Remember, it's important to thoroughly research and test different strategies before implementing them with your trading bot.

Jan 09, 2022 · 3 years ago

Jan 09, 2022 · 3 years ago - Using crypto trading bots can be a powerful tool in your trading arsenal. At BYDFi, we believe in the power of algorithmic trading and have developed our own advanced trading bot. Our bot utilizes machine learning algorithms to analyze market data and make intelligent trading decisions. It can automatically execute trades based on predefined strategies and indicators. With BYDFi's trading bot, you can take advantage of various strategies such as trend following, mean reversion, and breakout trading. Our goal is to provide traders with a reliable and efficient tool to enhance their trading experience. Give it a try and see the difference it can make in your trading strategy!

Jan 09, 2022 · 3 years ago

Jan 09, 2022 · 3 years ago

Related Tags

Hot Questions

- 90

How can I buy Bitcoin with a credit card?

- 81

How can I minimize my tax liability when dealing with cryptocurrencies?

- 75

What are the tax implications of using cryptocurrency?

- 60

What is the future of blockchain technology?

- 59

How can I protect my digital assets from hackers?

- 55

Are there any special tax rules for crypto investors?

- 40

What are the best practices for reporting cryptocurrency on my taxes?

- 37

What are the advantages of using cryptocurrency for online transactions?