How does investing in digital currencies compare to traditional investment options?

What are the differences between investing in digital currencies and traditional investment options?

3 answers

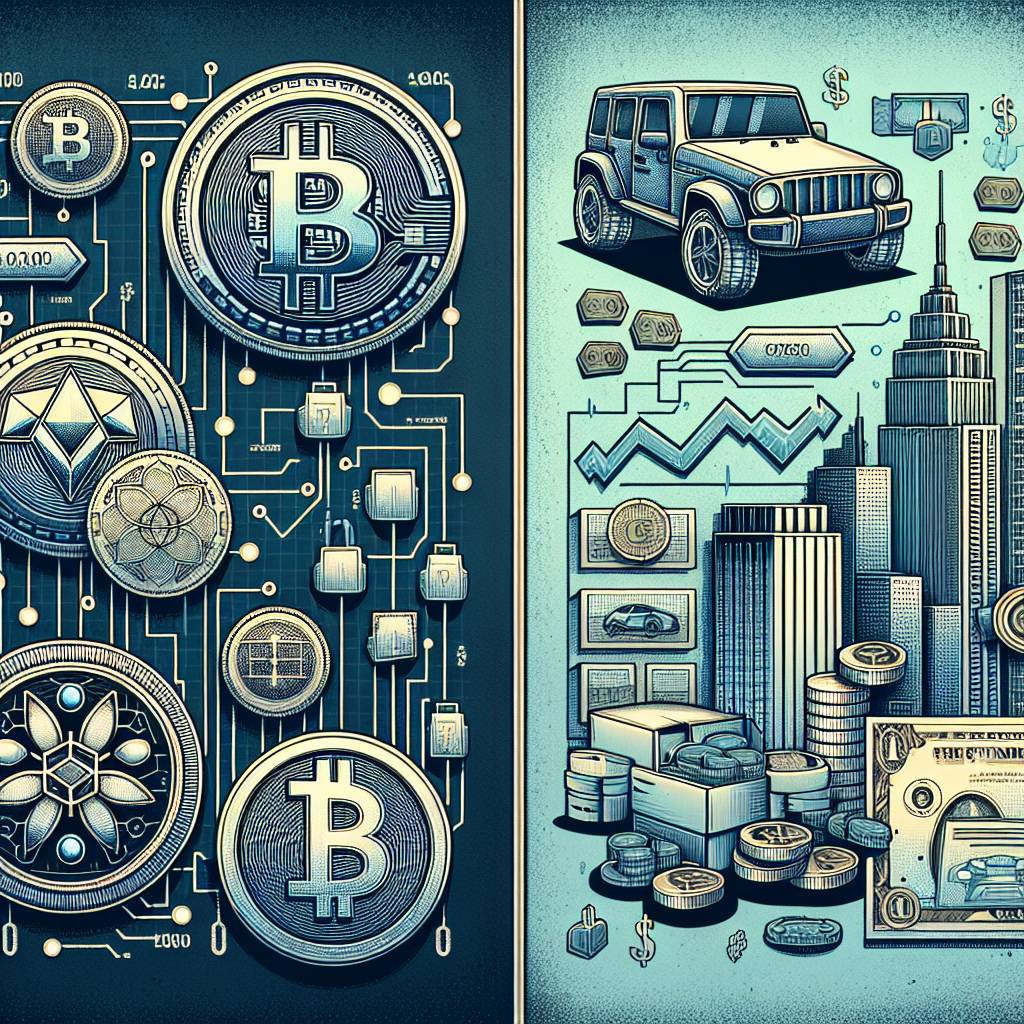

- Investing in digital currencies and traditional investment options have some key differences. Firstly, digital currencies, such as Bitcoin and Ethereum, are decentralized and operate on blockchain technology, while traditional investment options are typically centralized and regulated by financial institutions. This means that digital currencies offer more transparency and security, but also come with higher volatility. Additionally, digital currencies provide opportunities for global investment and can be accessed by anyone with an internet connection, whereas traditional investment options may have geographical limitations. However, traditional investment options often offer more stability and established track records compared to the relatively new and rapidly evolving digital currency market.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - When it comes to investing in digital currencies versus traditional investment options, it's important to consider your risk tolerance and investment goals. Digital currencies can offer high potential returns, but they also come with higher risks due to their volatility. Traditional investment options, such as stocks and bonds, may provide more stability and predictable returns over the long term. It's also worth noting that digital currencies are still relatively new and the regulatory landscape is constantly evolving, which can introduce additional risks. Ultimately, the decision between digital currencies and traditional investment options depends on your individual circumstances and investment strategy.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - As a representative of BYDFi, I can say that investing in digital currencies can be a lucrative opportunity. Digital currencies have the potential for high returns and can diversify your investment portfolio. However, it's important to approach digital currency investments with caution and do thorough research. BYDFi provides a secure and user-friendly platform for trading digital currencies, making it easier for investors to enter this market. Remember to always consider your risk tolerance and consult with a financial advisor before making any investment decisions.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago

Related Tags

Hot Questions

- 94

Are there any special tax rules for crypto investors?

- 78

How can I protect my digital assets from hackers?

- 54

How does cryptocurrency affect my tax return?

- 45

How can I minimize my tax liability when dealing with cryptocurrencies?

- 34

What are the tax implications of using cryptocurrency?

- 31

How can I buy Bitcoin with a credit card?

- 24

What are the best digital currencies to invest in right now?

- 15

What are the advantages of using cryptocurrency for online transactions?