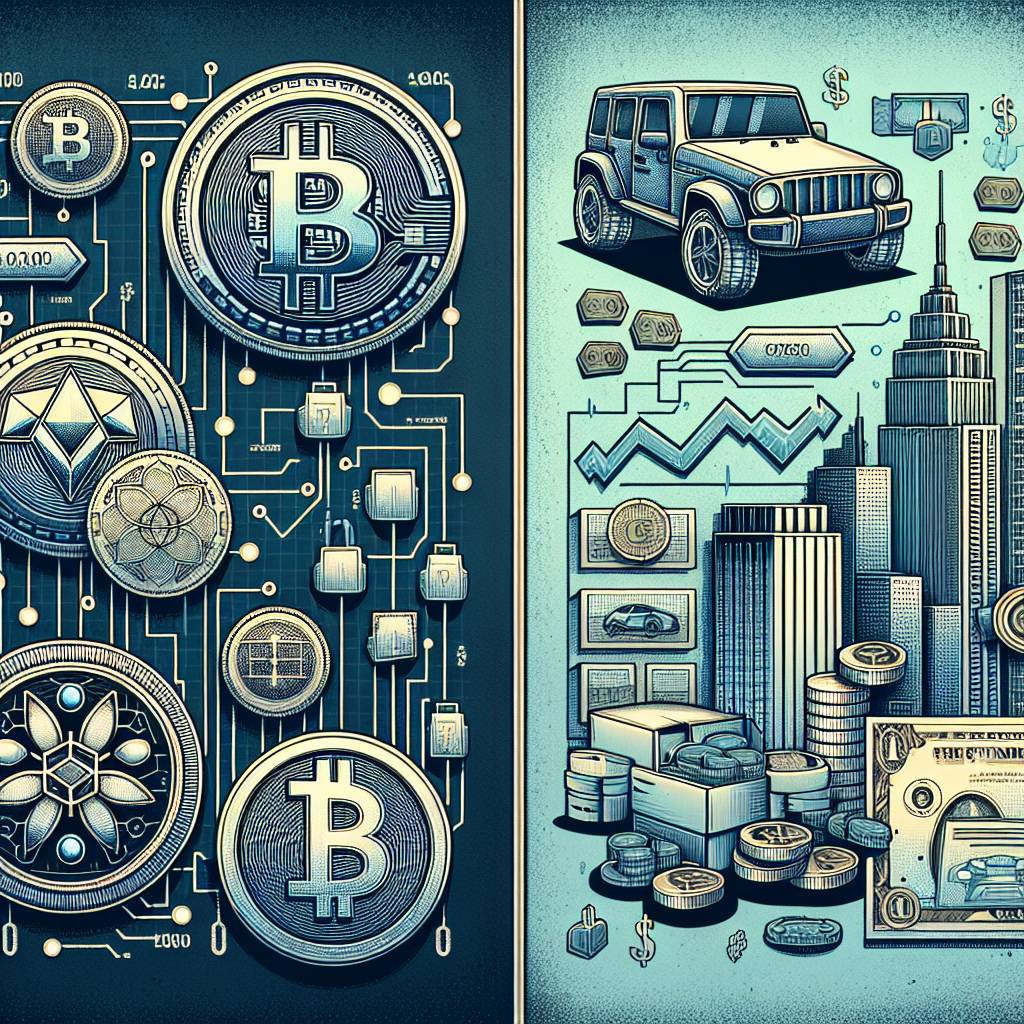

How does investing in cryptocurrencies compare to traditional annuities?

What are the key differences between investing in cryptocurrencies and traditional annuities? How do the risks, returns, and long-term prospects compare? Are there any advantages or disadvantages to consider when choosing between the two investment options?

8 answers

- Investing in cryptocurrencies and traditional annuities differ in several aspects. Cryptocurrencies, such as Bitcoin and Ethereum, are digital assets that operate on decentralized networks, while annuities are financial products offered by insurance companies. One key difference is the level of risk involved. Cryptocurrencies are known for their volatility and can experience significant price fluctuations, which can lead to both high returns and losses. On the other hand, annuities provide a more stable and predictable income stream, making them a safer option for risk-averse investors. Another difference is the potential for long-term growth. Cryptocurrencies have the potential for exponential growth, but also carry the risk of losing value. Annuities, on the other hand, offer a guaranteed income for a specified period or for life. When choosing between the two, investors should consider their risk tolerance, investment goals, and time horizon.

Dec 30, 2021 · 3 years ago

Dec 30, 2021 · 3 years ago - Investing in cryptocurrencies versus traditional annuities is like comparing a roller coaster ride to a steady paycheck. Cryptocurrencies can offer thrilling highs and heart-stopping lows, with the potential for massive returns or devastating losses. Traditional annuities, on the other hand, provide a reliable and consistent income stream, like clockwork. If you're someone who enjoys the excitement and can handle the risk, cryptocurrencies might be for you. But if you prefer stability and peace of mind, annuities are the way to go. It all comes down to your personal preferences and financial goals.

Dec 30, 2021 · 3 years ago

Dec 30, 2021 · 3 years ago - When it comes to comparing investing in cryptocurrencies and traditional annuities, it's important to consider your risk tolerance and long-term goals. Cryptocurrencies, like Bitcoin and Ethereum, have gained a lot of attention in recent years due to their potential for high returns. However, they also come with a higher level of risk and volatility. On the other hand, traditional annuities provide a guaranteed income stream, which can be appealing for those seeking a more stable investment option. It's worth noting that annuities typically offer lower returns compared to cryptocurrencies, but they also come with less risk. Ultimately, the decision between the two depends on your individual circumstances and investment objectives.

Dec 30, 2021 · 3 years ago

Dec 30, 2021 · 3 years ago - Investing in cryptocurrencies and traditional annuities are two different approaches to wealth accumulation. Cryptocurrencies offer the potential for significant returns in a relatively short period of time, but they also come with a higher level of risk. Traditional annuities, on the other hand, provide a more conservative investment option with a guaranteed income stream. The choice between the two depends on your risk tolerance, investment goals, and time horizon. If you're comfortable with the volatility and potential for high returns, cryptocurrencies may be worth considering. However, if you prioritize stability and a predictable income, traditional annuities may be a better fit for you.

Dec 30, 2021 · 3 years ago

Dec 30, 2021 · 3 years ago - Investing in cryptocurrencies and traditional annuities are two different strategies with their own pros and cons. Cryptocurrencies offer the potential for high returns, especially during bull markets, but they also come with a higher level of risk. Traditional annuities, on the other hand, provide a guaranteed income stream, which can be appealing for retirees or those looking for a stable source of income. It's important to consider your risk tolerance, investment goals, and time horizon when deciding between the two. Additionally, diversification is key. You can consider allocating a portion of your portfolio to cryptocurrencies while also investing in traditional annuities or other assets to balance the risk and potential rewards.

Dec 30, 2021 · 3 years ago

Dec 30, 2021 · 3 years ago - Investing in cryptocurrencies and traditional annuities are two different approaches to growing your wealth. Cryptocurrencies offer the potential for exponential growth and can be an exciting investment option for those willing to take on higher risk. Traditional annuities, on the other hand, provide a more conservative and predictable income stream. When comparing the two, it's important to consider your risk tolerance, investment goals, and time horizon. If you're looking for short-term gains and are comfortable with volatility, cryptocurrencies may be worth exploring. However, if you prioritize stability and a steady income, traditional annuities may be a better fit for your investment strategy.

Dec 30, 2021 · 3 years ago

Dec 30, 2021 · 3 years ago - Investing in cryptocurrencies and traditional annuities are two distinct investment choices with their own advantages and disadvantages. Cryptocurrencies offer the potential for high returns, but they also come with a higher level of risk and volatility. Traditional annuities, on the other hand, provide a guaranteed income stream, which can be appealing for those seeking a more stable investment option. When deciding between the two, it's important to assess your risk tolerance, investment goals, and time horizon. Additionally, diversifying your portfolio across different asset classes, including cryptocurrencies and annuities, can help mitigate risk and maximize potential returns.

Dec 30, 2021 · 3 years ago

Dec 30, 2021 · 3 years ago - Investing in cryptocurrencies and traditional annuities are like comparing a wild roller coaster ride to a calm and steady boat ride. Cryptocurrencies can be thrilling and offer the potential for massive returns, but they also come with a higher level of risk and uncertainty. Traditional annuities, on the other hand, provide a reliable and predictable income stream, making them a safer option for risk-averse investors. When deciding between the two, it's important to consider your risk tolerance, investment goals, and time horizon. If you're comfortable with the ups and downs of the cryptocurrency market and are seeking high returns, cryptocurrencies may be worth exploring. However, if you prefer stability and a steady income, traditional annuities may be a better fit for your investment strategy.

Dec 30, 2021 · 3 years ago

Dec 30, 2021 · 3 years ago

Related Tags

Hot Questions

- 99

Are there any special tax rules for crypto investors?

- 90

What is the future of blockchain technology?

- 85

How can I minimize my tax liability when dealing with cryptocurrencies?

- 76

What are the advantages of using cryptocurrency for online transactions?

- 74

What are the best digital currencies to invest in right now?

- 59

What are the best practices for reporting cryptocurrency on my taxes?

- 44

What are the tax implications of using cryptocurrency?

- 31

How can I protect my digital assets from hackers?