How does investing in cryptocurrencies compare to a traditional 529 plan?

What are the key differences between investing in cryptocurrencies and a traditional 529 plan? How do these two investment options compare in terms of risk, potential returns, and tax implications? Are there any advantages or disadvantages to consider when choosing between the two?

3 answers

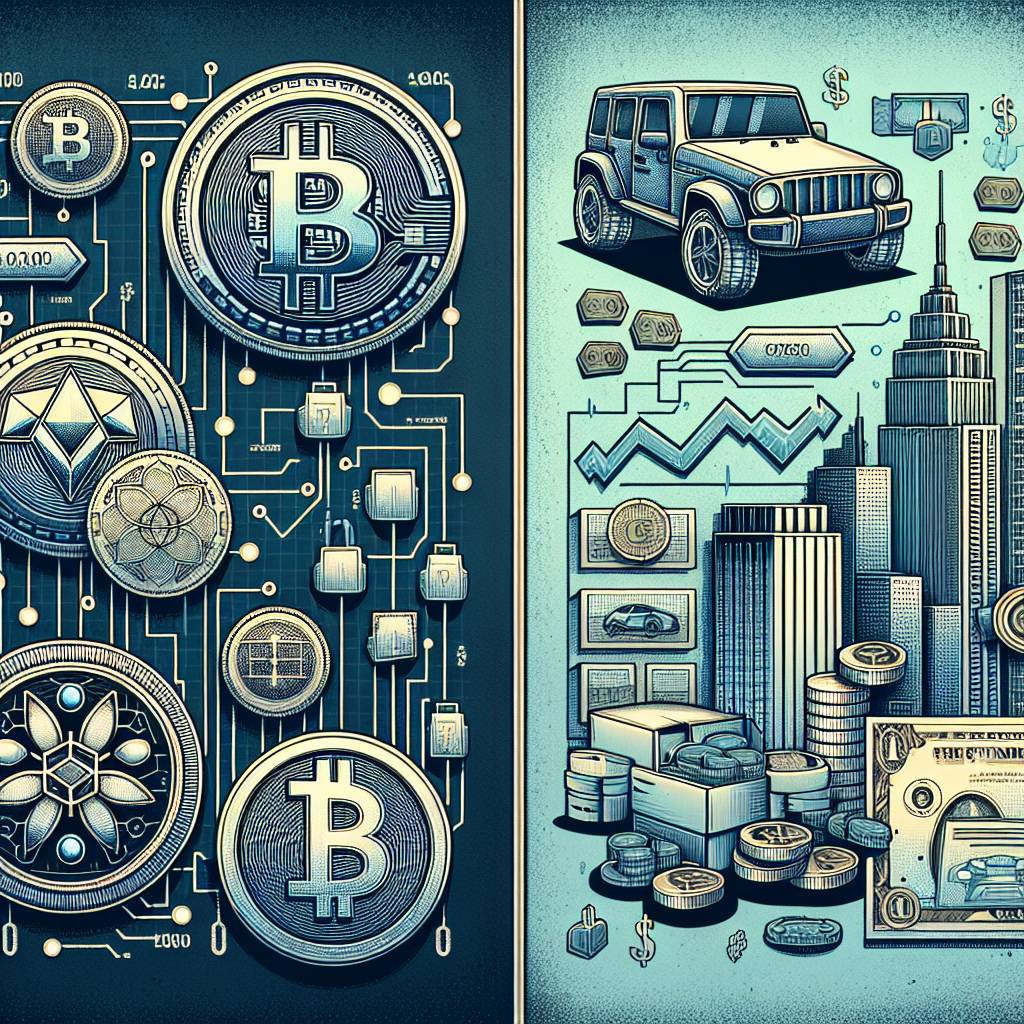

- Investing in cryptocurrencies and a traditional 529 plan are two distinct investment options with their own pros and cons. Cryptocurrencies, such as Bitcoin and Ethereum, offer the potential for high returns but also come with significant risks. The value of cryptocurrencies can be highly volatile, and there is a risk of losing your entire investment. On the other hand, a traditional 529 plan is a tax-advantaged savings account designed specifically for education expenses. It offers a more stable and predictable return, but the potential for high returns is generally lower compared to cryptocurrencies.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - When it comes to risk, cryptocurrencies are considered to be much riskier than a traditional 529 plan. The cryptocurrency market is highly speculative and can be influenced by various factors, including market sentiment, regulatory changes, and technological advancements. On the other hand, a traditional 529 plan is a more conservative investment option that focuses on long-term growth and stability.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - At BYDFi, we believe that diversification is key when it comes to investing. While cryptocurrencies can offer the potential for high returns, it's important to consider them as a part of a well-diversified investment portfolio. A traditional 529 plan, on the other hand, is specifically designed for education savings and can provide tax advantages that cryptocurrencies do not offer. It's important to carefully evaluate your investment goals, risk tolerance, and time horizon before deciding between the two options.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

Are there any special tax rules for crypto investors?

- 85

How can I minimize my tax liability when dealing with cryptocurrencies?

- 67

How can I protect my digital assets from hackers?

- 47

What are the best practices for reporting cryptocurrency on my taxes?

- 46

What are the best digital currencies to invest in right now?

- 44

What are the advantages of using cryptocurrency for online transactions?

- 42

How can I buy Bitcoin with a credit card?

- 34

How does cryptocurrency affect my tax return?